I Fought the IRS for Over $12K – and WON!

This is a story about how I overpaid my 2021 taxes due to an error in TurboTax and spent nearly three years trying to recover more than $12,000 from the IRS! I began writing this back in 2022, in the midst of frustration with TurboTax and the IRS, but waited to finish writing and publish it until I knew the ending. And I’m happy to say that although I had nearly given up hope, I successfully recovered my $12K tax refund, with interest, in 2025! I want to share the story not only because I think it’s fascinating, but because I also hope it helps anyone else who finds themself in a similar situation.

The Error

The story begins in back in March, 2022. Although I’d always disliked Intuit and knew they lobby to make taxes worse, I’d been using TurboTax to file my taxes for many years. Every time tax season rolled around, I just wanted a quick and cheap solution to get my taxes done. TurboTax was always the easy answer and, like always, I filed my 2021 taxes with TurboTax.

My 2021 tax situation was a little unique because I chose to exercise some Incentive Stock Options (ISOs). When you exercise ISOs, the bargain element is reported as a special kind of income on your taxes, and there are a bunch of complicated rules about how it gets taxed. In some cases, a rule called the alternative minimum tax (AMT) is triggered, which causes all your taxes for the year to be calculated using a completely different set of rules. This can be dangerous if you’re not expecting it, as you might owe much more than you anticipated at the end of the year if you’re not careful. Of course, I was aware of this and worked with a financial professional to understand roughly what I would owe.

TurboTax does handle ISOs, and my financial advisor even recommended I keep using TurboTax since I’d used it before and was comfortable with it. When I did my 2021 taxes, TurboTax didn’t ask me about ISOs in the income section. I wanted to be proactive about making sure I reported my income correctly, so I used TurboTax Help to search for ISOs and AMT. The TurboTax Help article said ISOs need to be reported on Form 6251 to calculate AMT, and provided a link to enter the data in TurboTax. I used the link to fill out data for Form 6251 in TurboTax and continued working through TurboTax. After completing most of the sections, it asked me a question about “odd tax situations”, including whether I’d exercised ISOs. I was slightly annoyed to re-enter some info since I’d already done this once after reading the help article, but I was also reassured TurboTax would handle things correctly since it was actually asking about this, so I entered all the info it asked for. Doing so made my tax refund change from a small refund to about $10K owed. That number was a little higher than I expected, but I had expected to owe some additional tax due to my ISOs, so I shrugged and paid my tax bill. It felt great to be done with my taxes, and filed them electronically in early March, 2022.

Finding the Error

A few days later, something didn’t seem right to me about the extra $10K I’d paid on my taxes. While I was aware that I might owe some extra tax, $10K was larger than I’d estimated I would owe with some simple spreadsheets. I’d also worked with my financial planner to avoid triggering too much AMT and, though our estimations weren’t exact, a $10K difference was more than either of us had expected. In general, AMT doesn’t get triggered until a certain amount of income, and I’d planned to use my ISOs in a way that wouldn’t trigger it (or might barely trigger it depending on my other income). So the $10K change in TurboTax due to AMT felt wrong. I looked closer at the actual tax forms TurboTax produces and sends to the IRS (the PDF) and found that the numbers were wrong. TurboTax had produced a Form 6251 that showed exactly double my ISO income!

After noticing that the ISO income TurboTax reported on Form 6251 was exactly double what it should be, I immediately suspected I knew what the problem was. (I’m a programmer; I know how these things work.) I’d entered my ISO info in two different forms in TurboTax – once after searching TurboTax Help for ISO and AMT, and again when TurboTax asked me about ISOs near the end. I’d originally assumed it was just validating or overwriting the numbers I’d already put in, but it was actually creating duplicates! (C’mon, how does software like TurboTax not validate against duplicate entry???) Bummer. I’d already filed my taxes and overpaid about $10K via direct deposit, and now I needed to get my money back. I actually didn’t think it would be too hard. I just needed to file an amended return showing my correct income and I’d get my refund. TurboTax has a built in process to amend your return, and they try to make it easy. (Oh, how naive!)

I used TurboTax to amend my return, and was careful to make sure I removed the duplicate ISO information. I looked at the amended 1040-X TurboTax generated. My ISO income was now so low that I didn’t actually trigger the AMT – as I’d originally intended, and my overall tax was reduced by more than $12K! My 1040-X showed that the IRS owed me a $12K refund on line 22. I was satisfied that TurboTax calculated things correctly this time, so I hit the submit button and TurboTax e-filed my amended return, just a few days after filing the original return.

Waiting

When you e-file and you owe money, the IRS is happy to take your money immediately via credit card or ACH withdrawal. Unfortunately, they’re not so quick when they owe you money. My original tax return was accepted in a few days, so I originally anticipated waiting about a week to get my refund. I waited… And waited… And waited some more. A month went by and I still hadn’t received my refund, nor had my return even been processed. As it turns out, the IRS was months behind on processing amended returns in 2022.

At the end of May, the agency had a backlog of 21.3 million unprocessed paper tax returns, an increase of 1.3 million over the same time last year.

Apparently, I was at the back of the line. I e-filed my amended return in early March, 2022, and it was not processed by the IRS until late March, 2023 – more than a year later.

The IRS website says processing for amended returns can take up to 16 weeks. In my case, it took more than 52! While I was waiting for my return to be processed, I repeatedly tried to check in with the IRS. The online Where’s My Amended Return tool showed that my return had been accepted in early March, 2022, and provided a phone number to call if it had been more than 16 weeks since the IRS accepted my return. I called this phone number several times over many months, each time waiting on hold for an hour only to be hung up on or told that the agent couldn’t tell me anything more than the website. My entire experience with the IRS was incredibly frustrating. They weren’t adhering to their own timelines and rules, but I had no recourse other than to wait. I considered hiring legal representation or a tax professional, but ultimately decided it wasn’t worthwhile yet – I figured they probably couldn’t do anything, and their fees might cut significantly into the $12K I was trying to recover.

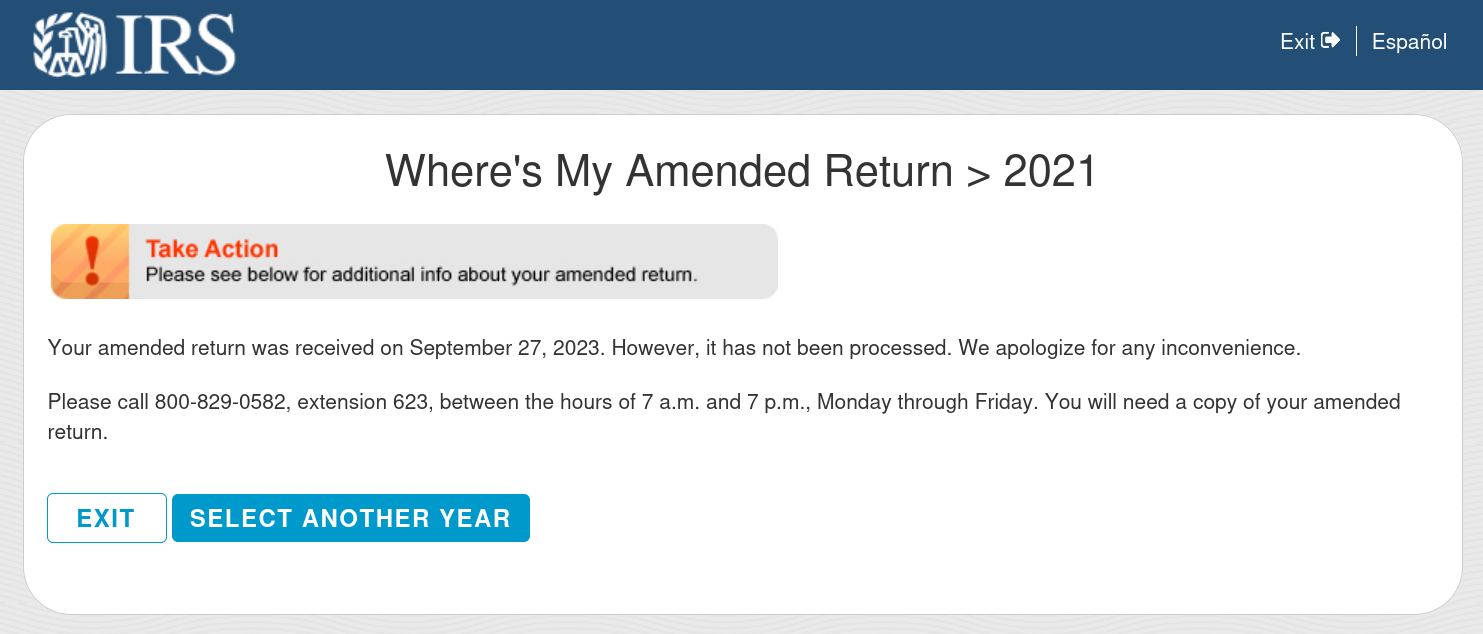

One day around March 2023, I checked the IRS website and noticed that my refund was finally marked as completed! I waited to receive something in the mail… And waited… And waited some more. I called after a week or so to say that I hadn’t received anything in the mail even though my refund was marked as completed, and was told that I should wait longer since the IRS systems can be slow and the mail can be slow. The IRS Where’s My Amended Return tool provides a number to call if your return was completed and you hadn’t received a notice. I called this number multiple times without getting anywhere. In just one example of the complete incompetence I dealt with, I called and said my return was marked as complete but I hadn’t received anything in the mail and was expecting a refund. I was told I’d called the wrong number and transferred to the refunds department. The refunds department told me there had been no refund issued and that they couldn’t give me any other info. The amount of “That’s not my department” I had to deal with was astounding, and an enormous waste of time.

I thought it was odd that the IRS agent told me no refund had been issued when my 1040-X, which was marked as “completed” on their website, showed a refund of $12K on line 22. So I looked into it more. I did some research, and I found out that you can request a transcript of your IRS records by logging in to the IRS Online Account page. I downloaded my transcript and compared it with my original return and my amended return. I noticed a line on my transcript, labeled “Form 6251”, that still showed the incorrect number from my original return. I dug into this more, and realized that the amended return generated by TurboTax didn’t include a Form 6251! That’s a smoking gun, if I’ve ever seen one! The IRS 1040-X FAQ says, “Include copies of any forms and/or schedules that you’re changing”, and TurboTax did not include Form 6251 in my amended return – so the IRS never changed my income from ISOs to the correct number. The duplicate entries produced by TurboTax on my original return were a bad user experience, but this was a straight-up bug.

The TurboTax Guarantee?

With the evidence that my 1040-X was incorrect because it was missing for 6251, I got on the phone with TurboTax. Luckily, as it was now mid-summer, tax season had passed and I was able to reach TurboTax Help pretty quickly. The TurboTax agent (a tax accountant I guess?) had me share my screen, and I presented what I’d found, suggesting that TurboTax should have included a Form 6251 with my amended return but they did not. He told me it didn’t matter – the IRS would use the value reported on my 1040-X, and Form 6251 didn’t need to be included since I didn’t owe any AMT on the amended return. (As it turns out, he didn’t know what he was talking about. 😂) When I pressed him that I hadn’t received my refund from the IRS, he told me that the IRS must either issue a refund (per line 22 of my 1040-X) or send me a notice to say that my amended return was incorrect, and he couldn’t do anything without this notice. Ugh. OK, fine. I’d call the IRS and ask for the notice.

Back on the phone, again, to dial the IRS number on the “Where’s My Amended Return” page. But this time I was armed with the info the TurboTax accountant gave me – the IRS either owed me a refund or owed me a notice to say why my amended return is incorrect. After another hour on hold, I spoke with perhaps the only competent agent in the IRS. (Or maybe I was just using the right words now – saying, “I never received a notice in the mail,” instead of, “I never received a refund.” If so, it’s a major flaw of the IRS that the response to “I never received a refund from my amended return,” is, “Let me transfer you to the refund department,” rather than, “Did you receive a notice?” or, “What info have you received?”) In any case, the agent was able to tell me that a notice had been mailed to me in March, 2023. To this day, I don’t know what happened to that notice. Most likely, I suppose it was lost in the mail and never delivered. The agent also, to my utter astonishment, was able to describe what the notice said. He said that basically, the IRS rejected my amended return because I didn’t provide Form 6251. He also mentioned that he could resend a copy of the notice, which I gladly accepted.

A couple weeks later, I did receive Notice 916-C in the mail. And, as the agent I spoke with suggested, it said that my amended return wasn’t accepted because it was missing Form 6251. Additionally, they wanted me to submit copies of Form 3921 showing my ISO income. I called TurboTax again, armed with the notice this time, but they continued to be utterly useless. They implied the rejection of the amended return was my fault since I didn’t include the right forms (even though TurboTax generated a Form 6251 in the original return and didn’t generate one in the amended return). If that’s my fault, what am I even paying them for?!? The support rep on the phone gave me the URL of a page where I could request a refund because of my dissatisfaction. I requested a refund, including the above info about their incorrect return and lack of support resolving the problem. They did not offer me a refund, and basically said that once their software generates a return they don’t offer refunds anymore, though they were happy to give me 30% off next year if I use them again. So much for a “biggest refund guarantee”.

The Bug in TurboTax

As a software engineer, the bug(s) in TurboTax seem obvious to me. The first problem is that I was able to enter my ISO info twice, in two separate parts of the UI, and they weren’t checked for duplication. It’s easy to see how their app could evolve over time to get to that place, but it should also be a relatively easy fix to remove one form or the other, and/or to check for unintentional duplicate entries. Whether or not we call that a bug, it was a terrible user experience. The second bug happened when I amended my return. On the original return, TurboTax automatically included Form 6251 for AMT. But then, when my edits made my income fall below the AMT threshold, TurboTax did not include Form 6251 or 3921. While this would have been correct on an original tax return, it is incorrect to not file From 6251 on an amended return if it had already been filed on the original return and had changed since then. Though it would be easy to introduce this bug in software by using the same logic to generate the amended return as was used for the original one. Although TurboTax support was unhelpful, I remain convinced that the problems with my amended return were due to a clear bug in their software.

Amending My Own Return

$10,000 is a weird amount of money when you need tax help. It’s big enough that it’s definitely worth a lot of time to try to recover it. At the same time, it’s not a huge amount of money. It felt like if I got professional tax help, I’d probably pay about $1-2K, and I’d be spending up to 20% of my refund money just to get the help I needed.

Since TurboTax wouldn’t provide the help I needed, I decided to just amend my return myself. Having my online tax transcript, Notice 916-C, and the 1040-X generated by TurboTax gave me confidence that I knew what was wrong and that I would be able to fix it. But I didn’t really want to start a new 1040-X from scratch. Fortunately, I didn’t have to! I realized the 1040-X TurboTax generated had all the right numbers, it was just missing extra documentation that TurboTax neglected to include. I found a blank Form 6251 online and followed the instructions to fill in the numbers, cross-referencing it with the original (doubled) Form 6251. As I expected, the corrected form showed $0 AMT on line 11. I printed out the amended 1040-X from TurboTax and my copies of Form 3921. I put these all together in the right order and mailed it to the IRS per their instructions for submitting an amended return.

This time, I knew what to expect… I waited… And waited… And waited some more. I’d mailed my return using Priority Mail with tracking, and the package sat somewhere (probably an IRS sorting facility or something) for nearly a month before tracking finally showed it’d been delivered. And of course, once it had been delivered, I was right back where I’d been a year earlier. Checking the “Where’s My Amended Return” website, like before, showed that my return was received but not processed.

After waiting more than a year (again), I became frustrated that my return still hadn’t been accepted! I did some more searching, and found a couple posts on Reddit that recommended reaching out to my congressional representative about my problems with the IRS. As it turns out, this works! I sent a short email explaining my situation to my representative on Jan 12, 2025 and heard back from their office the following day. On Feb 24, I got an email from my representative to notify me that the IRS was processing my case. And on Mar 26, I got a check in the mail from the IRS for my tax refund, plus interest for the extra three years they’d held my money!

Lessons and Observations

I’m really happy I got everything sorted out in the end, and I want to share some of the things I learned along the way.

Don’t overpay your taxes. It may be exceptionally difficult and slow to get your refund if you need to file an amended return.

Get help from your congressional representative if you have a difficult problem with the IRS. I experienced much, much better customer service from my congressional representative than from the IRS themselves. Your representative probably isn’t the right place to go for simple questions, but they may be very helpful if you have a problem that’s been difficult to resolve.

I don’t recommend TurboTax. I know, I know, it’s still the easiest way to do your taxes for most normal tax situations. But as you can see, the guarantees all over their website seem somewhat meaningless. And they do lobby congress to make your taxes worse.

Consider doing your taxes yourself (instead of using TurboTax). Because of my frustration with TurboTax, I started doing my own taxes by hand, without TurboTax or any other tax software. I’ve done this two years in a row now, and it’s been a really positive experience. It’s free, I know I won’t run into any bugs in TurboTax, and I know I’m not giving money to Intuit. It’s actually a lot easier to do your own taxes than most people think it is, and now that I’ve done it I have a much better understanding of how my taxes are calculated. It’s easy to get started, and it feels a lot like a standardized test – just follow the instructions for Form 1040.

The government should make all this easier. The US is one of the only countries in the world where people have to report their own income to the government every year (and a big reason for that is the companies like TurboTax that make so much money from it). In almost all cases, the government already knows how much tax you owe before you tell them anything. If fixing this was a priority for our politicians, none of us would have to file taxes ever again!

About the Author

👋 Hi, I'm Mike! I'm a husband, I'm a father, and I'm a staff software engineer at Strava. I use Ubuntu Linux daily at work and at home. And I enjoy writing about Linux, open source, programming, 3D printing, tech, and other random topics. I'd love to have you follow me on X or LinkedIn to show your support and see when I write new content!

I run this blog in my spare time. There's no need to pay to access any of the content on this site, but if you find my content useful and would like to show your support, buying me a coffee is a small gesture to let me know what you like and encourage me to write more great content!

You can also support me by visiting LinuxLaptopPrices.com, a website I run as a side project.

Related Posts

- I Did My Own Taxes By Hand (and You Can Too!) 15 Mar 2024

- Monitoring Gross Income with Lunch Money 19 Sep 2022

- SkillsUSA 2008 Nationals 30 Jun 2008